Evan Foo is a rising MBA2 and interning at Macquarie this summer. He is specializing in Finance and Leadership & Change Management and is a member of the Asian Business Society, Graduate Finance Association, and the Stern Private Equity Club.

Evan Foo is a rising MBA2 and interning at Macquarie this summer. He is specializing in Finance and Leadership & Change Management and is a member of the Asian Business Society, Graduate Finance Association, and the Stern Private Equity Club.

NYU Stern’s “Summer Internship Series” sheds light into Sternies’ internship experiences. Posts are written by rising MBA2s who are currently working at their summer internship.

Stern Transition

Growing up, I did not imagine I would one day be working in a bank. My journey has taken me from a budding entrepreneur in Silicon Valley, a venture capitalist for the Singapore government and a CEO of a wireless speaker business to becoming a student of finance at Stern and in Wall Street. Prior to Stern, I had developed a keen understanding of early stage business and finance, but wanted the complete picture of the corporate lifecycle, and resolved to learn firsthand Wall Street’s role in shaping global companies and markets.

With its reputed strength in finance and location in the heart of New York City, Stern provided the perfect opportunity to make this transition. Connecting these dots in my career led to my summer in investment banking with Macquarie being an ideal platform for continued development.

Choosing Macquarie

One of the first considerations when recruiting for investment banking is to understand the nuances of each firm, and where your fit lies. I was first attracted to Macquarie because of its unique merchant banking function, under the Principal Transactions Group (PTG). Macquarie not only provided transaction advice and debt financing, but could also use its balance sheet to make equity investments in companies. Macquarie thus offered the best of both worlds and slightly more. The stability and resources of a bulge bracket bank, the work experience of a boutique (through leaner deal teams) and the ability to forge unique relationships with clients and sponsors.

The second is to determine what you want from your summer experience. The leaner teams at Macquarie provided the hands-on experiences I was looking for. Being able to work directly with Managing Directors, build models and interact with clients were big draws for me. Having gotten along well with the bankers from the firm and demonstrated technical competency for the job, I was offered a summer associate role in the Financial Institutions Group (FIG). The managing director of the fintech team was from Stern, and I looked forward to working with him.

Macquarie Experience

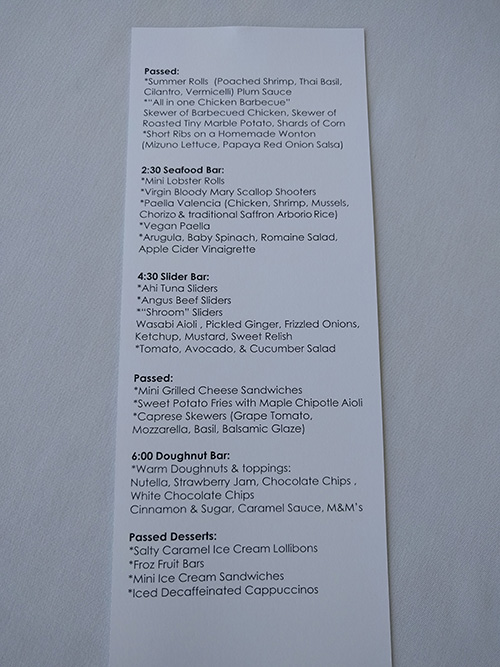

Walking past the revolving doors for the first time, tales of endless summer work and play from predecessors set the foundation on which expectation was built. My peers comprised of former investment managers, bankers, models, and engineers, yet everyone started on a level playing field during the first week of training. Soon we would be caught up in the whirlwind of work, volunteering, baseball games, charity runs and summer outings to managing directors’ homes, all of which presented various aspects of life in the industry. Staffers (typically Vice Presidents in charge of assigning projects and managing work flow within a group) protected our time for such events that not only provided reprieve from work but also an opportunity to deepen relationships with colleagues outside the work environment. Playing soccer with colleagues before dipping into the pool on a hot summer day was a personal highlight. All in a day’s work.

The workspace was aptly called the bullpen, the arena where everyone sat, from analysts to managing directors. Observing first-hand how a managing director operates and manages clients daily was already a key learning point for me. My day-to-day responsibilities throughout the internship would evolve from due diligence and industry research to managing analysts, building financial models, and co-leading a cross-border buy-side deal. The buy-side transaction offered the deal experience I had so desired, as I was involved in a critical stage of the deal and worked directly with a managing director. Another project with the PTG team was a welcomed bonus and it provided additional exposure across groups.

Take-aways

Walking past the revolving doors for the last time, it was comforting to know my contributions were appreciated and recognized by my team. Our buy-side progressing to the final phase made all the hard work pay off. Make no mistake about it, investment banking is a demanding job, the people we work with and the contacts we can call on make all the difference. I am therefore very thankful for the support provided by the Stern banking community in my group, firm, cohort, and across Wall Street, that has helped define my recruiting process and summer experience. In the same way, I hope to pay it forward.